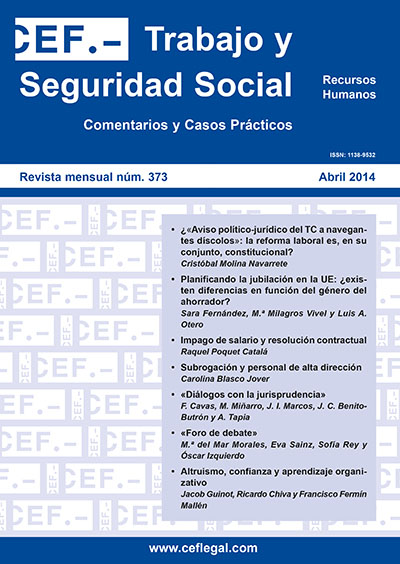

Retirement planning in the European Union: are there gender differences according to the saver?

DOI:

https://doi.org/10.51302/rtss.2014.2914Keywords:

retirement, saving, gender, determinants, EuropeAbstract

This paper analyse if the women have the same probability of saving for retirement than their male counterparts in the European Union (EU). Moreover, we study if these determinants of saving for retirement are different according to the gender. The sample consists of 6,036 individuals from eight European countries (France, Germany, Italy, Netherlands, Poland, Sweden, UK and Spain) in 2007. Overall, the results show that European women are less likely to save for retirement than European men. However, the determinants of this saving are quite similar between the two groups. Finally, we find that country institutional factors have a significant and more relevant than gender differences in the individual's attitude towards saving for retirement.

Downloads

References

Alessie, R.; Van Rooij, M. y Lusardi A. [2011]: «Financial literacy and retirement preparation in the Netherlands», Journal of Pension Economics and Finance, 10 (4), págs. 527-545.

Almenberg, J. y Säve-Söderbergh J. [2011]: «Financial literacy and retirement planning in Sweden», Journal of Pension Economics and Finance, 10 (4), págs. 585-598.

Australia and New Zealand Banking Group [2005]: ANZ Survey of Adult Financial Literacy in Australia.

Badunenko, O.; Barasinska, N. y Schäfer D. [2009]: «Risk attitudes and investment decisions across european countries - Are women more conservative investors than men?», Working Paper, n.º 928, DIW Berlín.

Bajtelsmit, V. [1999]: «Evidence of risk aversion in the health and retirement study», Workin Paper of Department of Finance and Real Estate, Colorado State University.

Bajtelsmit, V. y Bernasek, A. [1996]: «Why do women invest differently than men?», Working Paper of Association for Financial Counselling and Planning Education.

Bajtelsmit, V.; Bernasek, A. y Jianakopolos, N. A. [1999]: «Gender differences in defined contribution pension decisions», Financial Services Review, 8, págs. 1-10.

Bartus, T. [2005]: «Estimation of marginal effects using margeff», The Stata Journal, 53, págs. 309-329.

Browning, M. y Lusardi, A. [1996]: «Household saving: Micro theories and micro facts», Journal of Economic Literatures, 34, págs. 1.797-1.855.

Bucher-Koenen, T. y Lusardi, A. [2011]: «Financial literacy and retirement planning in Germany», Journal of Pension Economics and Finance, 10 (4), págs. 565-584.

Choi, J. [2006]: «The role of derived rights for old-age income security of women», OECD Social, Employment and Migration Working Papers, n.º 43.

Deere, C. D. y Doss, C. R. [2006]: «The gender asset gap: what do we know and why does it matter?, Feminist Economics, 12, págs. 1-50.

DeVaney, S. y Chiremba, S. [2005]: «Comparing the retirement savings of the baby boomers and other cohorts», Working Paper of US Department of Labor, Bureau of Labor Statistics.

Díaz-Serrano, L. y O'Neill, D. [2004]: «The relationship between unemployment and risk-aversion», IZA Discussion Paper, n.º 1.214.

Dohmen, T.; Falk, A.; Huffman, D.; Schupp, J.; Sunde, U. y Wagner, G. [2005]: «Individual risk attitudes: new evidence from a large, representative, experimentally-validated survey», Discussion Paper, n.º 511.

Dwyer, P.; Gilkesonb, J. y List, J. [2002]: «Gender differences in revealed risk taking: evidence from mutual fund investors», Economic Letters, 76, págs. 151-158.

European Commission [2007]: «The EU Market for consumer long term retail savings vehicles. Comparative analysis of products, market structure, costs, distribution systems and consumer saving patterns», European Commission.

Folbre, N.; Shaw, L. B. y Stark, A. [2005]: «Introduction: Gender and Aging», Feminist Economics, 11 (2), págs. 3-5.

Fornero, E. y Monticone, C. [2011]: «Financial literacy and pension plan participation in Italy», Journal of Pension Economics and Finance, 10 (4), págs. 547-564.

Gerrans, P. y Clark-Murphy, M. [2004]: «Gender differences in retirement savings decisions», Journal of Pension Economics and Finance, 32, págs. 145-164.

Hatch, L. R. [1992]: «Gender differences in orientation toward retirement from paid labor», Gender & Society, 61, págs. 66-85.

Hayes, C. y Parker, M. [1993]: «Overview of the literature on pre-retirement planning for women», Journal of Women and Aging, 44, págs. 1-18.

Hinz, R.; McCarthy, D. y Turner, J. [1996]: «Are women conservative investors? Gender differences in participant-directed pension investments in Positioning Pensions for the Twenty-First Century», Philadelphia: Pension Research Council and University of Pennsylvania Press.

Huberman, G.; Iyengar, S. y Jiang, W. [2007]: «Defined contribution pension plans: determinants of participation and contributions rates», Journal of Financial Services Research, 311, págs. 1-32.

Jefferson, T. [2009]: «Women and retirement pensions: a research review», Feminist Economics, 15 (4), págs. 115-145

Jelinek, T. y Schneider, O. [1998]: «Influence of pension funds on private savings in a transition country», Prague: Charles University CERGE-EI, June.

Jianakopolos, N. A. y Bernasek, A. [1998]: «Are women more risk-averse?», Economic Inquiry, 364, págs. 620-630.

Johannisson, I. [2008]: «Private pension savings: gender, marital status and wealth-evidence from Sweden in 2002», licentiate thesis, University of Gothenburg, School of Business, Economics and Law.

Li, J.; Phillips Montalto, C. y Geistfeld, L. [1996]: «Determinants of financial adequacy for retirement», Financial counseling and planning, 7, págs. 39-48.

Lind, J. T. y Mehlum, H. [2007]: «With or without U? - The appropriate test for a U shaped relationship», MPRA Paper, University Library of Munich, n.º 4.823.

Lusardi, A. [2001]: «Explaining why so many households do not save», Center for Retirement Research Working Paper 2001-05, vol. September.

Lusardi, A. y Mitchell, O. [2007]: «Baby Boomer retirement security: The roles of planning, financial literacy, and housing wealth», Journal of Monetary Economics, 541, págs. 205-224.

— [2011]: «Financial literacy around the world: an overview», Journal of Pension Economics and Finance, 10 (4), págs. 497-508.

Malroutu, L. y Xiao, J. J. [1995]: «Perceived adequacy of retirement income», Financial Counseling and Planning, 6, págs. 17-23.

Moreno-Badía, M. [2006]: «Who saves in Ireland?: The micro evidence», IMF Working Paper, n.º 06/131, May 2006.

OCDE [2008]: «OECD employment outlook 2008», París: OCDE.

— [2009]: «Pensions at a Glance 2009: Retirement-Income Systems in OECD Countries», París: OCDE,

— [2011]: «Pensions at a Glance 2010: Retirement-Income Systems in OECD Countries», París: OCDE,

Papke, L. [2003]: «Individual financial decisions in retirement saving plans: the role of participant-direction», Journal of Public Economics, 881-2, págs. 39-61.

Schubert, R.; Brown, M.; Gysler, M. y Wolfgang Brachinger, H. [1999]: «Financial Decision-Making: Are women really more risk-averse?», American Economic Review (Papers and Proceedings), 89, págs. 381-385.

Seong-Lim, L.; Myung-Hee, P. y Montalto, C. P. [2000]: «The effect of family life cycle and financial management practices on household saving patterns», International Journal of Human Ecology, 11, págs. 79-93.

Shaw, L. B. y Hill, C. [2002]: «The gender gap in pension coverage: What does the future hold», Washington, DC: Institute for women's policy research, Retrieved April, vol. 24.

Shaw, L. B., y Lee, S. [2005]: «Explorations gender and aging: cross-national contrasts», Feminist Economics, 11, págs. 117-143.

Sundén, A. y Surette, B. [1998]: «Gender differences in the allocation of assets in retirement savings plans», American Economic Review, 882, págs. 207-211.

VanDerhei, J. y Olsen, K. [2000]: «Social security investment accounts: Lessons from participant-directed 401 (k) data», Financial Services Review, 9, págs. 65-78.

Wang, P. [1994]: «Brokers still treat men better than women», Money, 256, págs. 108-10.