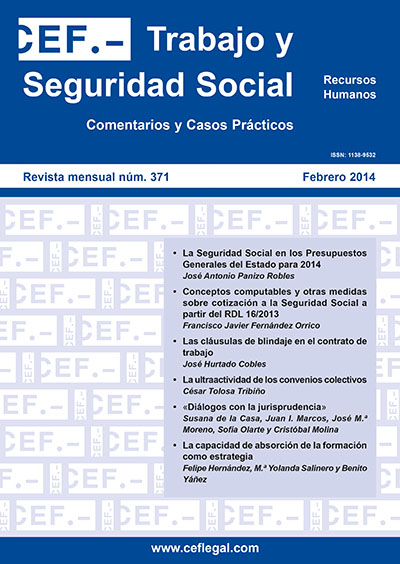

Social Security in the Spanish National Budget for 2014

DOI:

https://doi.org/10.51302/rtss.2014.2860Keywords:

Social Security, contribution base, revaluation, sustainability factor, retirementAbstract

The Social Security legislation has experienced major changes at the beginning of 2014. These changes have derived from the Law 22/2013, in effect on 22 December, the Spanish National Budget for 2014 (LSNB 2014), and the influence of other legal or statutory rulings.

The LSNB 2014, besides authorizing expenses, estimates and income of the Social Security system, lays out basic standards regarding the determination of Social Security contributions, such as those related to pension updates. This issue, in relation to other business years, is experiencing a major variation in response to Law 23/2013, in effect on 23 December, which regulates the Sustainability Factor and Revaluation Index of the Social Security Pension System.

Regardless, the LSNB 2014 partially modifies the regulation of the application field in the Social Security system; of the temporary disability, permanent disability and unemployment benefits; of the management of the Social Security Mutual Insurance for Labor Accidents and Professional Illnesses or of the mandatory cooperation for companies; as well as of the Special Regulations for National Civil Servants or of the Regulations for National Inactive Classes.

At the same time, though Law 23/3013 comes into effect on 1 January 2019, it incorporates the so-called «sustainability factor» into the Social Security pension system, which establishes an automatic adjustment factor affecting the retirement pension amounts, depending on the evolution of life expectancy at age 67.

Finally, the Royal Decree-Law 16/2013, of 20 December, which includes measures to favor stable hiring and improve the employability of workers, besides certain one-time modifications regarding unemployment contributions from part-time workers, or with respect to the minimum contribution base of different self-employed workers, changes article 109 of the General Social Security Law regarding the determination of the contribution base, which results in one more step in the comparison between the Social Security contribution base and the taxable base for income tax purposes.

Throughout this paper, the contents of the mentioned legal texts will be analyzed, as far as they affect the Social Security system regulations.